The Real Cost of Zoning

The Invisible Tax

Executive Summary

Zoning is a method of land-use planning in which a local governmental entity divides land into areas that determine its location, size, use of land/buildings and density. In most cities across the state, zoning laws prohibit the construction of relatively affordable homes — duplexes, triplexes, quads and larger multifamily units. Economists from across the political spectrum agree that zoning laws artificially drive up prices by limiting the supply of housing that can be built in a region. Further, single-family- only zoning means that a builder must seek special permission to construct compact housing, a process that ultimately makes it more expensive to build these much needed ‘missing middle’ housing units.

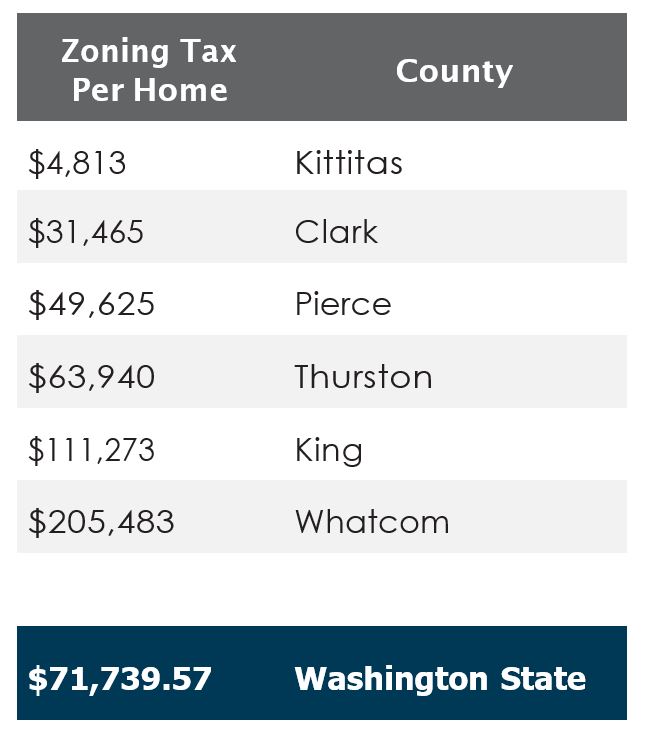

Statewide, zoning accounts for $71,739 of the cost of a newly constructed home.

The results from this study show that zoning ordinances increase the cost of new home construction by as little as $4,800 and as much as $243,000, depending on location. Statewide, zoning accounts for $71,739 of the cost of a newly constructed home.

Introduction

Extremely high home prices have raised concerns about homeownership opportunities for families of all income levels. In fact, 72% of Washingtonians cannot afford to purchase a median-priced new home (National Association of Home Builders, Priced-Out Estimates 2021).

This report analyzes the impact of restrictive residential land-use restrictions (zoning) on land values across, and within, select counties in Washington. Using micro data on vacant land purchased to develop single-family housing from CoStar, BIAW implemented the empirical strategy developed by Gyourko and Krimmel for estimating ‘zoning taxes’—the amount by which land prices are bid up due to supply side regulations.

Using the gap between extensive and intensive margin values of land for single-family home development, BIAW estimated zoning taxes for select jurisdictions in the state. Generally, unless there are regulations preventing the increase in density, there should be no gap between land values on the intensive and extensive margins. Extensive margin land values in excess of intensive margin prices are a clear prediction from price theory of the presence of burdensome supply side regulations.

Our results indicate that zoning taxes are especially burdensome in larger, more densely populated areas of the state. These results align with trends discovered in the national study produced by Gyourko and Krimmel.

Methodology

Joseph Gyourko is the Martin Bucksbaum Professor of Real Estate, Finance and Business & Public Policy at The Wharton School of the University of Pennsylvania. He has published numerous pieces of research on housing and economics. Jacob Krimmel is an applied microeconomist specializing in urban and real estate economics and household finance. He is currently an economist at the Federal Reserve Board in the Division of Research and Statistics.

Gyourko and Krimmel created an empirical strategy for estimating ‘zoning taxes’ nationally, which BIAW applied on a state and local level.

To replicate this study, BIAW acquired the database, CoStar: a well-known data provider in the real estate industry that tracks land sales. This source provides observations of prices paid for vacant land parcels with the intent of building single-family housing units on the land, and lists how many housing units the developer intends to construct.

Additionally, BIAW restricted the analysis to parcels whose future use is identified as single-family, rather than multi-family. In eliminating multi-family housing units from the analysis, BIAW discovered many areas in the state have less – and often no – data available. This finding indicates that some areas of the state are experiencing more growth in the multi-family segment of the housing industry. This could be due to jurisdictions offering developer incentives for construction of multi-family structures and jurisdictional policies that limit single-family home construction, among other reasons.

To complete the zoning tax calculations, BIAW used the land sales data from CoStar over a five-year period (2015-2020) because there are a relatively small number of vacant land transactions within any one year. Similar to Gyourko and Krimmel, BIAW wanted the shortest and most recent period of time available without retrieving data skewed from Great Recession.

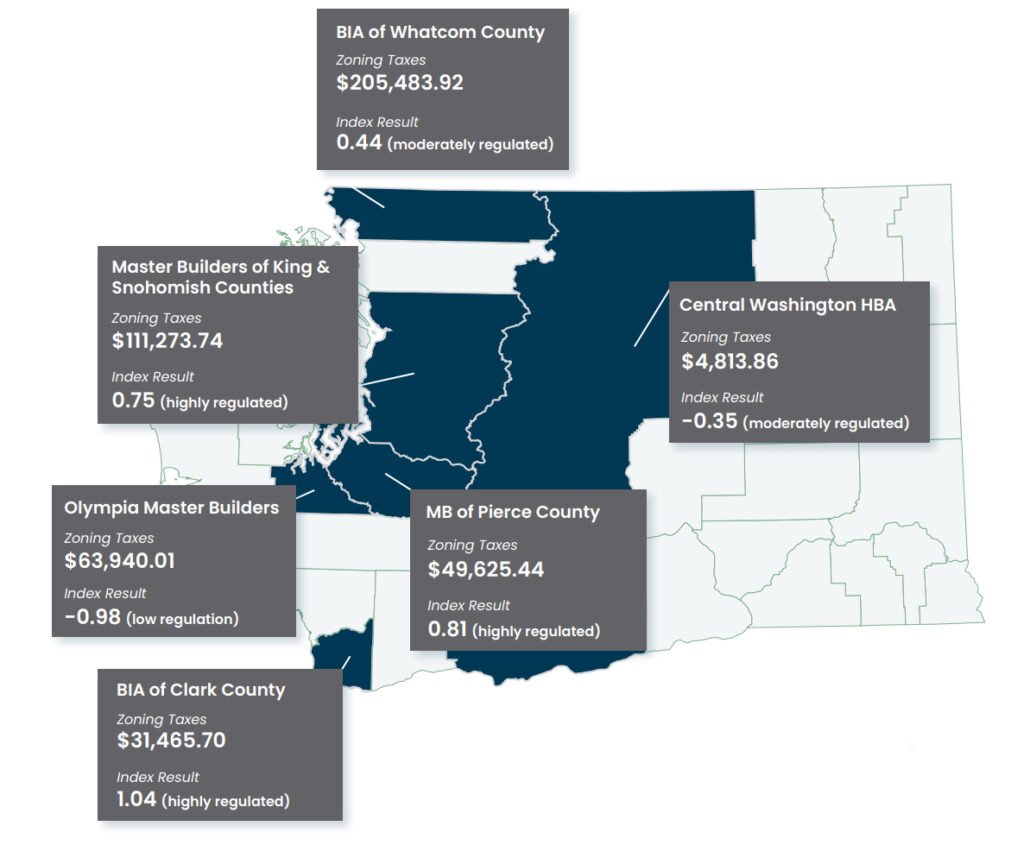

Since BIAW is comprised of local home builder associations, we have grouped calculations into the six local associations with available data: Central Washington Home Builders Association, Building Industry Association of Clark County, Master Builders of King and Snohomish Counties, Olympia Master Builders, Master Builders of Pierce County and the Building Industry Association of Whatcom County. To complete our assessment of zoning taxes, we have also calculated a state zoning tax.

To further assess the results, BIAW utilized the data set Dr. Gyourko had provided us for the WRLURI18 Distribution Values, which measures level of regulation per jurisdiction. In their study, Dr. Gyourko and Dr. Krimmel compared amount of zoning taxes and level of regulation to draw conclusions. BIAW deeply appreciates the sharing of this data to further our understanding of the amount of regulation in Washington state.

Source

*Gyourko, J., Krimmel, J. (2021, July). The Impact of Local Residential Land Use Restrictions on Land Values Across and Within Single Family Housing Markets. National Bureau of Economic Research: https://www.nber.org/papers/w28993

Limitations

This report has limitations due to the assumptions used within zoning tax equations:

Small sample size

Due to the limited number of vacant land sale transactions in the state each year and incomplete information for some land sale transactions found in the CoStar database, there is a small sample size to use in our calculations. Gyourko and Krimmel listed similar limitations in their study so this should not be of concern.

Potential biases from non-randomness in underlying small samples of observations of the extensive margin land values in the state

This also is similar to the concerns listed by Gyourko and Krimmel and does not threaten the validity of the findings.

Grouping of zoning taxes by local association

This has the ability to misrepresent zoning taxes of the less populated or inactive building counties included in said local association.

Due to the inability to access data from CoreLogic as Gyourko and Krimmel have, BIAW used National Association of Home Builders data to calculate zoning taxes

This includes average lot size, average finished area, average price per square foot by finished area, average price per square foot by lot size, and the average cost to build a home.

Results

Our replication of the Gyourko and Krimmel study indicates the zoning taxes as follows:

The WRLURI2018 index was created from survey responses about regulatory processes and key rules by which housing production is restricted across jurisdictions. Index values increase with degree of regulation so that a value of one implies the underlying regulatory environment is one standard deviation more restrictive than that for the national average. Nationally, 25 percent of the most highly regulated communities in the country have an aggregate index value above 0.64.

Only one of the local associations has an index value that indicates low levels of regulation (low levels of regulation are the bottom quartile of distribution, where WRLURI < -0.690). However, Olympia Master Builders includes Thurston County, which did not complete all the questions on the self-administered survey sent out by Gyourko and Krimmel’s research team. If the permit approval delay index has any indication of regulation, then the 17.69 months of delay experienced in Thurston County should provide an example of the actual level of regulation within this jurisdiction.

The other local associations and the state have index values that indicate moderate or high levels of regulation. Higher levels of regulation may contribute to higher zoning taxes in an area. This would indicate there are factors (such as density restrictions, zoning ordinances, and open space requirements) that artificially increase the cost of land and thus the final sales price of new single-family housing units.

Therefore, our research indicates that high zoning taxes lead to higher house prices throughout Washington state. To combat skyrocketing housing prices, the state and localities should focus on making zoning ordinances friendlier to single-family home construction if they truly prioritize housing affordability and attainability for their constituents.