First-in-the-nation long-term care tax coming soon

July 26, 2021

Washington will soon become the first in the nation to offer long-term care benefits for all workers in the state. The new benefits won’t be available to eligible residents until 2025, but employers must start collecting the new payroll tax from ALL Washington-based employees in January 2022 to fund these benefits. Here’s what you need to know and some resources for your employees.

Seven in 10 will need long-term care benefits in their lifetime

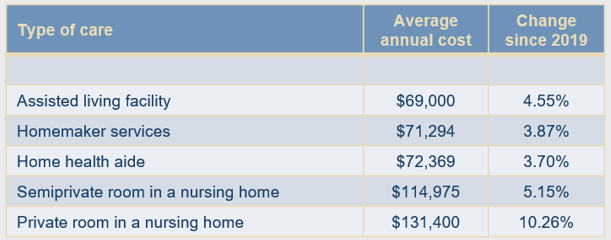

As many of us with aging relatives have learned, long-term care is expensive and not covered by Medicare. According to a leading long-term care insurance company, average annual costs for care as of August 2020 range from $69,000 for an assisted living facility to more than $131,000 for a private room in a nursing home.

Payroll tax collection starts January 2022

Starting in January 2022, the Long-Term Services and Supports (LTSS) Trust Act requires employers to collect a 0.58% payroll tax from all employees (with no income limit)—unless the employee applies and is approved for an exemption. Withholding for an employee making $50,000/year would be $290/year or $24.17/month.

Every employee contributes – employers do not. If you are self-employed, you can opt-in to the Trust.

Up to $36,500 in lifetime benefits available

The state will start paying the benefits to eligible individuals in January 2025. Each person may receive a lifetime benefit of up to $36,500 to pay for long-term services and supports, regardless of the lifetime value of their contribution.

The benefit can be used for a range of services and supports, such as:

- Professional personal care in your home, an assisted living facility, an adult family home or a nursing home

- Adaptive equipment and technology like hearing devices and medication reminder devices

- Home safety evaluations

- Training and support for paid and unpaid family members who provide care as well as respite care

- Home-delivered meals

- Memory care and dementia supports

- Environmental modifications like wheelchair ramps

- Personal emergency response system

- Transportation

Eligibility is limited to Washington residents with significant challenges

To qualify for benefits, you must meet the WA Cares contribution requirements by the time you apply. You must have worked and contributed to the fund for:

- At least 10 years at any point in your life without a break of five or more years within those ten years, or

- Three of the last six years at the time you apply for the benefit, and

- At least 500 hours per year during those years.

You must also need help with at least three activities of daily living, such as:

- Medication management

- Personal hygiene

- Eating

- Toileting

- Cognitive functioning

- Transfer assistance

- Body care

- Bathing

- Ambulation/mobility

- Dressing

Employees must purchase private insurance to avoid the tax

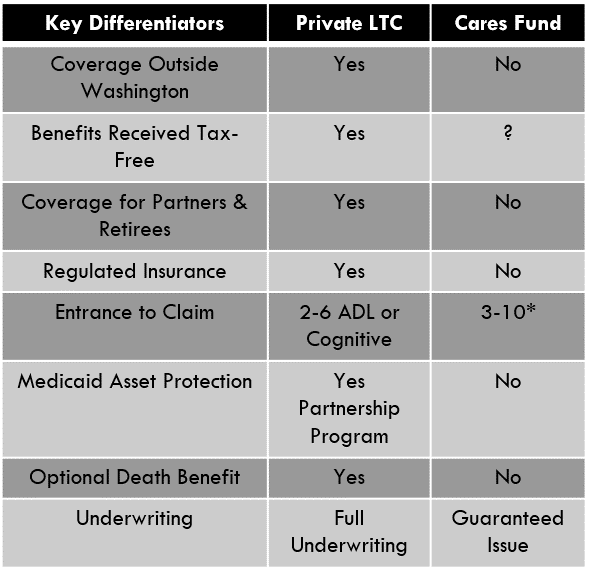

To qualify for the exemption, an employee must purchase a private long-term care insurance plan by Nov. 1, 2021 and apply for an exemption between Oct. 1, 2021 and Dec. 31, 2022. There are significant differences between the state plan and private plans. The following chart developed by BIAW member Biggs Insurance highlights just a few.

You can help your employees by providing them the basic information and encouraging them to contact their personal financial advisor or local insurance provider.

More information

The WA Cares team invites you to learn more about the WA Cares Fund and get your questions answered. Pre-registration to attend is not required. For meeting dates and times as well as links to the webinars, visit: http://www.wacaresfund.wa.gov/learn-more/

They’ve also provided an employer information page, employer toolkit and general information flyer.